Get the cash you need at the best rates, with the service and convenience you deserve.

A credit union loan can be a quick, affordable way to get the cash you need for whatever is next for you. Let us help you fund college, buy a home or a car, refinance your mortgage, get a credit card with low interest rates, and more. SCU is with you through it all, and we can help you fund it all.

Learn more about how credit union loan rates compare to conventional bank loan rates, then find the loan below that’s right for you.

Explore our loan options, and reach out today to begin your application. With SCU, getting your next loan is as easy as: 1, 2, 3…

Whether you’re in the market for a family car or you’re ready to find that RV, motorcycle, boat, or other type of vehicle, we offer low rate auto loans, plus great rates on other loans, with the quick approval and flexible terms you need to feel confident about your financing.

SCU Auto Loans Feature:

Apply in person at your local Scott Credit Union branch, or from one of the many local car dealerships that off Scott Credit Union financing. Learn more by clicking the button below.

Get a personal credit union loan to consolidate debt, manage emergency expenses, fund holiday or back to school purchases, and more. We’ll match you with the right loan and the right interest rates and terms to help you stay on track with your financial plan.

Consumer Loans include:

Apply for personal loans and learn more about current loan rates, special offers, and repayment terms by clicking the button below.

You might not normally think of credit cards as loans, but in essence, they’re a method of taking out recurring short-term loans with a pre-approved maximum loan limit. Scott Credit Union credit cards can be a helpful way to build credit, maximize purchasing power, and enjoy fixed low interest rates and no annual fees.

Choose your credit card today, and start earning rewards with a card that’s right for you:

Scott Credit Union offers educational credit union loan options in partnership with Sallie Mae®. Visit the Sallie Mae website for information about student loan options for undergraduate or graduate higher education.

Features of our Home Equity Line of Credit:

Note: The rate on an SCU HELOC is subject to change monthly based on the Wall Street Journal Prime Rate.

Think of Scott Credit Union first when it comes to home loans. Our team of professional loan advisors will work with you to take the stress out of the mortgage process, whether buying or refinancing your existing loan.

Explore what the SCU full service mortgage department can do to help you qualify for your next:

Learn more about what our mortgage team can do for you, from zero down payment options to fixed rate loans, and more. Click the button below to choose your credit union loan product and contact the Mortgage Loan Originator who can help you experience a quick, stress-free mortgage application process.

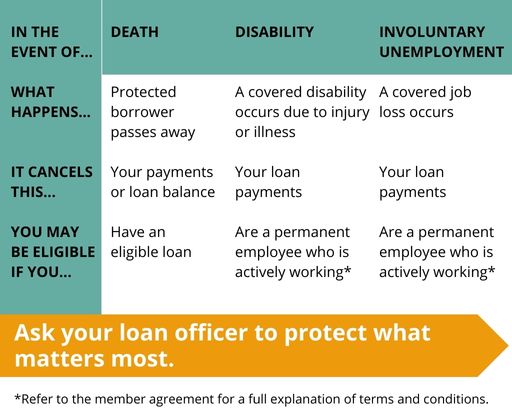

Does your family have a safety net if the unexpected hits? Insuring your loan balance or loan payments against death, disability, or involuntary unemployment could help protect your finances.

Debt protection plans could cancel your loan balance or payments up to the contract maximums. Life Plus adds protection for life events such as accidental dismemberment, terminal illness, hospitalization, family medical leave, and the loss of life of a non-protected dependent. Protect your loan balance or loan payments today so your family can worry a little bit less about tomorrow.

Disclosure: Your purchase of debt protection is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative, or refer to the Member Agreement for a full explanation of the terms of debt protection. You may cancel the protection at any time. If you cancel protection within 30 days you will receive a full refund of any fee paid.

Scott Credit Union is there to help to our members who will not be paid due to a shutdown of the U.S. government. Please note, this loan is only available during times of a U.S. government shutdown.

Members will need to have had their government payroll directly deposited into a Scott Credit Union account or provide your two most recent paystubs***.

To apply stop by any of the Scott Credit Union branches or call us at (618) 345-1000.

*The maximum loan amount will be equivalent to that of the last net pay within 30 days prior to the request.**The rate is 0% APR. For example, if $1,000 is borrowed and the rate is 0% APR for 6 months, the monthly payment would be $166.67. Other restrictions may apply. Contact us for details. ***Paystubs must have been issued within the previous 45 days.

Pay your SCU loan using one of our convenient payment options. Click each section to learn more:

Make a SCU Loan Payment from your SCU Account

Use your SCU login to access your online account dashboard and transfer credit union loan payments from your SCU checking or savings account.

Make a SCU Loan Payment from a non-SCU Account

Make a one-time online loan payment from a checking account at another financial institution using our online payment tool. You’ll need your routing number and account number for the account you’ll use for payment, as well as your SCU member number, the last four digits of the account holder’s Social Security Number, or that member’s birthday.

Call our Member Contact Center at (800) 888-4728 or stop by any of our Illinois or Missouri branches to set up automatic loan payments from your SCU account. You can also make a payment using a debit card from a non-SCU checking account for a $15 fee (phone payments only).

Make a one-time online loan payment from a checking account at another financial institution using our online payment tool. You’ll need your routing number and account number for the account you’ll use for payment, as well as your SCU member number, the last four digits of the account holder’s Social Security Number, or that member’s birthday.

Make a recurring payment from another financial institution by submitting an ACH authorization using the link below.

Skip-A-Payment

If you have taken out a Consumer loan through Scott Credit Union, you may be eligible to take advantage of Skip-A-Pay1. SCU understands that life happens and that sometimes making your loan payment can be difficult. This service is great to use when your budget is tight and allows you to skip a payment on your loan once per year during the time that’s best for you.

If you choose to take advantage of our convenient and flexible Skip-A-Pay service, please remember:

- There is a fee of $25 for each skipped payment per loan.2

- You are limited to 5 skips per the life of your loan.

- You may only use Skip-A-Pay once per calendar year.

- Skip-A-Pay is available any month of the year!

If you’re ready to make the most of your loan and utilize Skip-A-Pay click the link below. If you want to learn more, visit your local branch or call the SCU Member Contact Center at (618) 345-1000.

Check Eligibility for Skip-A-Pay

1Home Equity Lines of Credit, Credit Cards, Certificate secured loans are not eligible. The Skip A Pay program does not include: 1st Mortgage Loans, Lot Loans, Construction Loans, and Closed End Second Mortgages.

2 A non-refundable fee of $25 per loan will be charged for exercising this service. The fee can be debited from an SCU share/checking or added to your loan balance. The addition of the fee to your loan balance will result in additional interest accruing on your loan. The fee and additional interest will result in a larger total amount of payments on your loan. Finance charges will continue to accrue during the Skip-A-Payment period and will be payable with your next payment. Your payments will resume the month following your skipped payment. You understand that making this change may extend the final payment date beyond what is listed on your original note. As a reminder, if you have set up an automatic payment via SCU Online Banking, your other bank’s bill pay service, or any other external method, be sure to cancel it for the month you are skipping. Skipping a loan payment may affect available benefits if you have purchased GAP insurance or credit insurance on your loan.

Contact the SCU consumer lending team or mortgage lending team to discuss your needs and get one-on-one help finding the credit union loan solution that is right for you. Scott Credit Union is with you, and your family, to help you continue to make smart borrowing choices and build a healthy financial future.