Get pre-approved for low-rate auto loans from your local Scott Credit Union or trusted car dealer.

Whether you want to get pre-approved or apply for financing at the dealership, Scott Credit Union will work with you to find the right loan with the best interest rate and terms for you.

When you get a pre-approval, dealers know that you’re a serious buyer. Plus, you know you have great, low-rate financing from SCU.

| Model Years | Minimum Loan Amount | Term | APR1 |

|---|---|---|---|

| 2027-2025 | $25,000 | 84 Months | as low as 6.74% |

| 2027-2025 | $15,000 | 72 Months | as low as 4.99% |

| 2027-2025 | $5,000 | 60 Months | as low as 4.49% |

| 2024-2021 | $25,000 | 84 Months | as low as 7.99% |

| 2024-2021 | $15,000 | 72 Months | as low as 5.94% |

| 2024-2021 | $5,000 | 60 Months | as low as 4.94% |

| 2020-2017 | $15,000 | 72 Months | as low as 8.99% |

| 2020-2017 | $5,000 | 60 Months | as low as 7.49% |

| 2016 & Older | $5,000 | 60 Months | as low as 9.49% |

If you’re looking for financing for your next motorcycle, RV, boat, or other vehicle, Scott Credit Union vehicle loans can help with that, too.

Find rates and terms for your next vehicle purchase by model year using the tabs below. Then, start your Scott Credit Union auto loan application to finance your purchase.

| Model Years | Minimum Loan Amount | Term | APR2 |

|---|---|---|---|

| 2027-2025 | $15,000 | 72 Months | as low as 9.24% |

| 2027-2025 | $5,000 | 60 Months | as low as 8.24% |

| 2027-2025 | $500 | 48 Months | as low as 7.99% |

| 2024-2021 | $15,000 | 72 Months | as low as 9.74% |

| 2024-2021 | $5,000 | 60 Months | as low as 8.74% |

| 2024-2021 | $500 | 48 Months | as low as 8.49% |

| 2020-2017 | $5,000 | 60 Months | as low as 9.99% |

| 2020-2017 | $500 | 48 Months | as low as 10.24% |

| 2016 & Older | $500 | 48 Months | as low as 10.99% |

| Model Years | Minimum Loan Amount | Term | APR3 |

|---|---|---|---|

| 2027-2025 | $35,000 | 180 Months | as low as 10.45% |

| 2027-2025 | $15,000 | 120 Months | as low as 9.70% |

| 2027-2025 | $10,000 | 84 Months | as low as 8.95% |

| 2027-2025 | $5,000 | 60 Months | as low as 8.45% |

| 2024-2021 | $35,000 | 180 Months | as low as 11.45% |

| 2024-2021 | $15,000 | 120 Months | as low as 10.70% |

| 2024-2021 | $10,000 | 84 Months | as low as 9.95% |

| 2024-2021 | $5,000 | 60 Months | as low as 9.45% |

| 2020-2017 | $15,000 | 120 Months | as low as 11.20% |

| 2020-2017 | $10,000 | 84 Months | as low as 10.45% |

| 2020-2017 | $5,000 | 60 Months | as low as 9.95% |

| 2016 & Older | $15,000 | 120 Months | as low as 11.70% |

| 2016 & Older | $10,000 | 84 Months | as low as 10.95% |

| 2016 & Older | $5,000 | 60 Months | as low as 10.45% |

Looking for more ways to pay?

Once your application has been approved, you may need to complete one of the forms listed below. Your SCU representative can direct you to the appropriate document.

Please find links to download your application documents below:

Illinois Affirmation of Correction – One in the Same

Illinois Affirmation of Correction – Remove Joint Owner

Illinois Boat Power of Attorney

Illinois Secretary of State Power of Attorney

Missouri General Affidavit – One in the Same

Missouri General Affidavit – Remove Joint Owner

After completion, please upload your lending documents through the link below.

Whether you depend on your vehicle for work or getting your family to school and activities, you need transportation that’s safe and reliable. The older your vehicle, the more likely there will be a breakdown. The cost of those breakdowns increases as the vehicle gets older. Not making small repairs can lead to even more expensive repairs. Ignoring repairs can be dangerous.

Mechanical Repair Coverage (MRC) can help deflect some of those costly covered repairs while keeping your vehicle running extra miles and extra years. With various coverage levels and deductibles to choose from, there’s a plan to fit your family’s budget.

Contact us to learn more about our coverage options.

Disclosure: Mechanical Repair Coverage is provided and administered by Consumer Program Administrators, Inc. in all states except CA, where coverage is offered as insurance by Virginia Surety Company, Inc., in NH, where coverage is provided and administered by Consumer Program Administrators, Inc. dba Consumer Warranty Program Administrators, in TX, where coverage is provided and administered by Consumer Program Administrators, Inc. dba The Administrators of Consumer Programs (TX License#175), in FL and OK, where coverage is provided and administered by Automotive Warranty Services of Florida, Inc. (Florida License #60023 and Oklahoma License #44198051), and in WA, where coverage is provided by National Product Care Company and administered by Consumer Program Administrators, Inc., all located at 175 West Jackson Blvd., Chicago, Illinois 60604, 1-800-752-6265. This coverage is made available to you by CUNA Mutual Insurance Agency, Inc.

The purchase of Mechanical Repair Coverage is optional. This document provides general information about Mechanical Repair Coverage and should not be solely relied upon when purchasing coverage. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions, and exclusions. Coverage varies by state. Replacement parts may be new, used, non-OEM or remanufactured of like kind and quality.

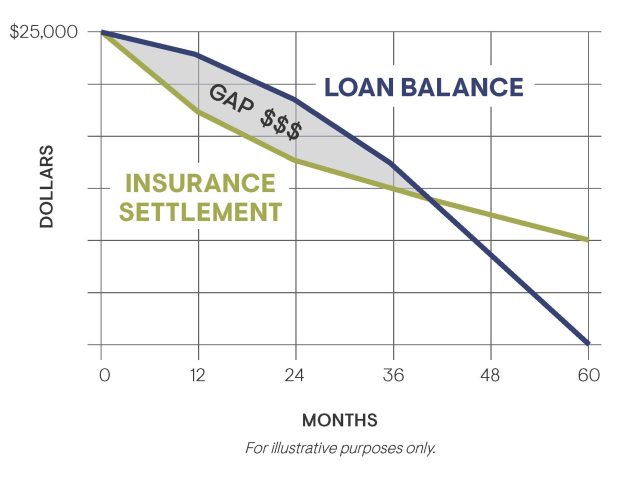

Your auto insurance may not cover the entire loan balance owed for a wrecked vehicle. That’s where Guaranteed Asset Protection (GAP) can provide peace of mind.

GAP may reduce or even eliminate that insurance pay-out shortfall in the event your vehicle is deemed a total loss. GAP with Deductible Assistance is designed to provide financial relief when your vehicle is damaged, but not deemed a total loss. If auto repairs cost more than your deductible, the deductible amount is applied to your loan, reducing what you owe.

Fair market insurance value isn’t always fair. There may be a gap. Protect your vehicle loan—purchase GAP with Deductible Assistance today!

Disclosure: Your purchase of MEMBER’S CHOICE™ Guaranteed Asset Protection (GAP) is optional and will not affect your application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to our loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

Contact the SCU consumer lending team to discuss your needs and get one-on-one help finding the credit union loan solution that is right for you. Scott Credit Union is with you, and your family, to help you continue to make smart borrowing choices and build a healthy financial future.